The illustration below shows that the "Business" is currently activated (greyed out) and is intended to be deactivated.

TABLE OF CONTENTS

- A. Check if you have irrelevant figures via Business section

- B. Remove the ABN

- C. Remove the Trading Name

- D. Revert to ? the Small Business Entity indicator

- E. Remove the imported Financials

- F. Remove Depreciation

- Remove item not related to Business

You can follow the steps below to deactivate the "Business" section.

A. Check if you have irrelevant figures via Business section

ie, open the "Business" tab and delete schedules or zero figures in it, then you will be able to deactivate the Business tab

.

B. Remove the ABN

Try to remove the 'ABN' and 'Anzsic Code' from your client's "Settings".

NOTE: In preparing a Trust Tax Return, ABN number can still be retained in the client Settings and the Business section can still be deactivated.

C. Remove the Trading Name

If, doesn’t have business, then, remove trading name from General - Settings page.

D. Revert to ? the Small Business Entity indicator

E. Remove the imported Financials

Remove the imported financials since it is unnecessary because it has no business.

ie these details in the tax form is either manual input it or you have an imported financials, and you need to remove

Guide: Removing Imported Financials

For the "Depreciation" that has been imported/injected through the tax form, and don’t want to include financial amounts in tax return, user can add “Do not import to tax return” tag to their accounts.

F. Remove Depreciation

Check Depreciation section is turned off.

If you're unable to turn off "Depreciation," go to "Tools" and update or remove the Asset categorized under "Business".

and/or "Rollback the date to remove.

For the "Depreciation" that has been imported/injected through the tax form, and don’t want to include financial amounts in tax return, user can add “Do not import to tax return” tag to their accounts.

Validation:

Now, try to remove the ticked or deactivate the Business section and then try to validate the form again.

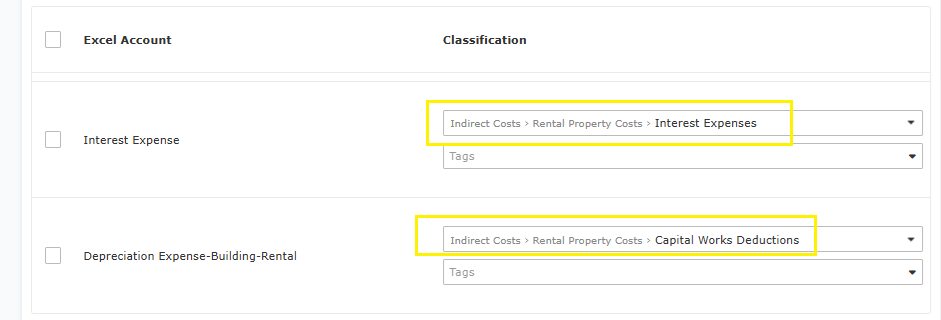

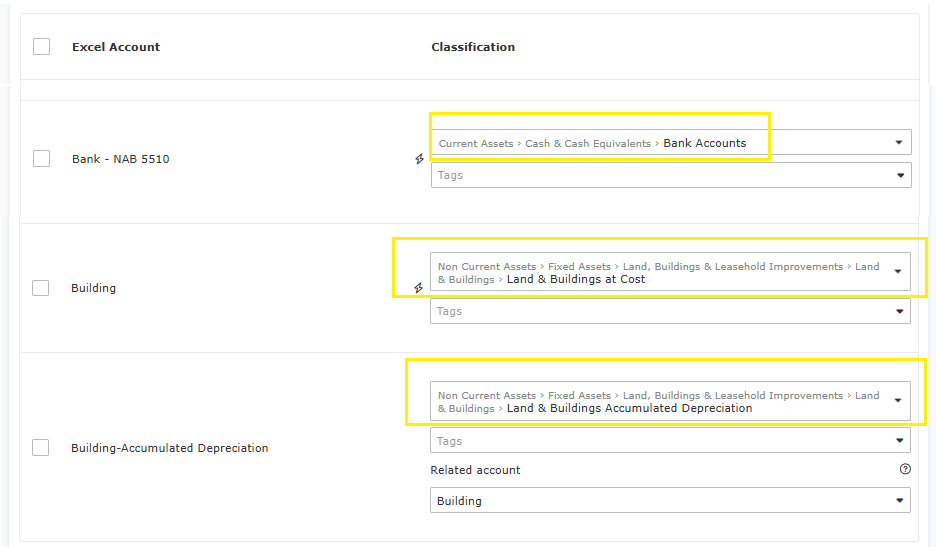

If depreciation related accounts which user has in their financials is non-business, then they should be marked with appropriate tag or account mapping to avoid the issue in activating the Business section:

Sample images below as your guide on how to map accounts related financials that is Non-Business related:

In case this doesn't resolve your issue, please send us a pdf copy of your tax form.

Related guide: