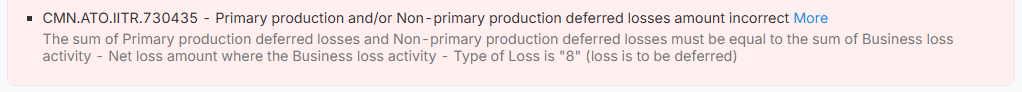

Validation Details:

Suggested Solution:

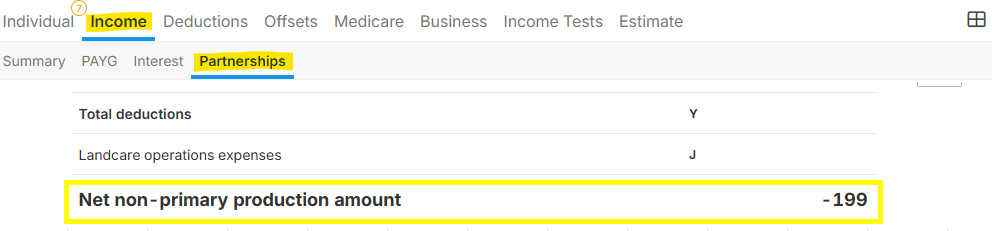

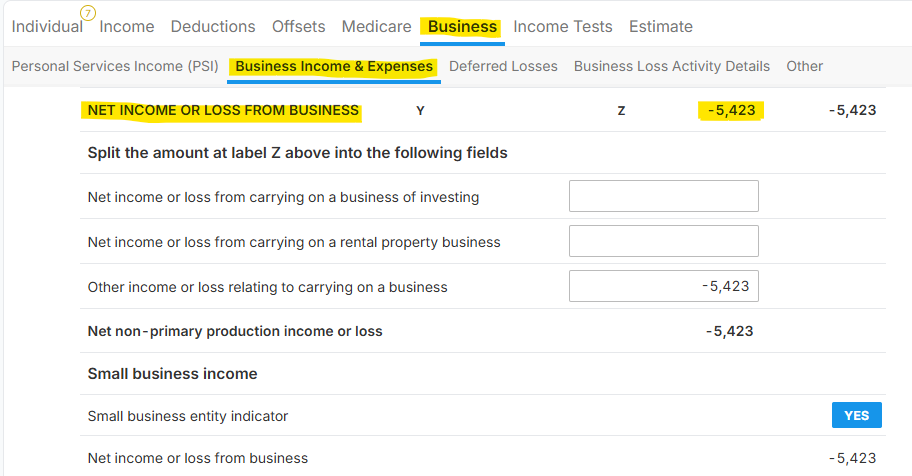

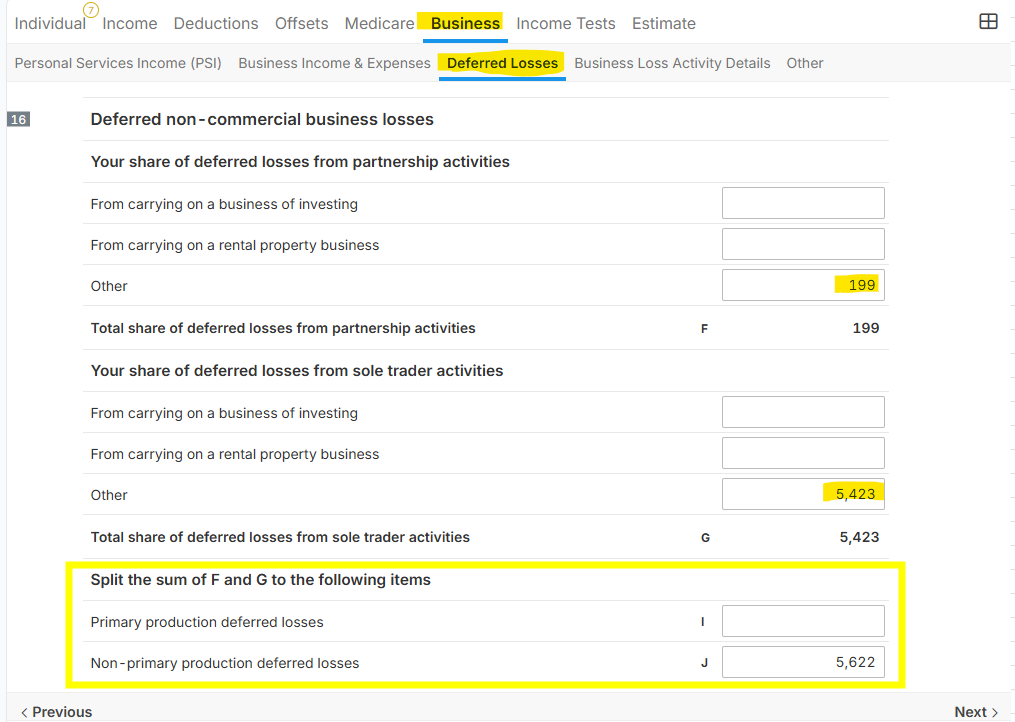

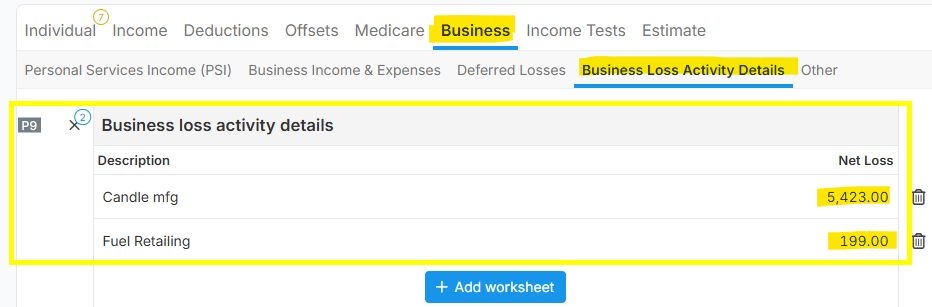

Example Data:

- Share of Partnership Loss of $-199

- Sole Trader business loss of $-5,423

NOTE: To resolve the error, you need to ensure that the sum of Item I and J in Label 16 (199+5,423 = 5,622) deferred losses amount under Deferred Losses tab is the same with total Net Loss amounts of all the worksheets in "Label P9-Business Loss Activity Details" (5,423+199 = 5,622) under "Business >Business Loss Activity Details" tab.

- Label 16 ( Sum of Item 1 & J) - total amount is 5,622

- Label P9 (Business loss activity details) - total is 5,622 (5,423+199)

NOTE: Ensure to select "8 - Loss must be deferred" as the "Loss Type" inside each Business loss activity details for each loss amount that you are deferring. Below is the sample image:

Related article: How to use Deferred Business Losses (Carried forward Loss) in Individual Tax Return (ITR)

FAQ:

Question: If the taxpayer is not operating the business (where the business had a non-commercial loss in 2020). If there is no business activity in 2021, then I suppose the only reason to carry the non-deferred loss through from prior year is to reach a new grossed-up value.

Answer: ie, it's only useful if there is business activity for the given business in 2021. If the business restarts in 2022, simply include the 2020 non deferred loss as an opening balance in that year.